Every year, leading brand valuation consultancy Brand Finance puts thousands of the world’s biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 150 most valuable and strongest brands in the telecoms industry are included in the annual Brand Finance Telecoms 150 2023 ranking.

U.S. based brand Verizon remains the world’s most valuable telecoms brand for the 4th consecutive year despite a 3% year-on-year reduction taking its brand value to US$67.4 billion.

Following a pandemic-led boom in wireless internet demand, Verizon has lost subscribers to fast-growing rivals in the telecoms industry in 2022, contributing to its slight brand value decrease. Verizon’s 5G network will be the brand’s primary focus going forward. On top of this, wireless mobility and nationwide broadband are set to be two of the most significant contributors to its planned growth in 2023. It is focusing on innovation, continued investment, and the incorporation of advanced technology deployment to provide a better offering to consumers, businesses, and the public sector alike.

Deutsche Telekom brand value up 5% on rollout of 5G in US and globally

Deutsche Telekom (brand value up 5% to US$62.9 billion) is again both the 2nd most valuable telecoms brand globally and Europe’s most valuable brand. This impressive performance comes partly as a result of the brand’s strong organic revenue growth within European markets, with customer numbers growing at a steady rate across the board. However, the brand’s value has grown substantially in connection with its record customer additions in the United States.

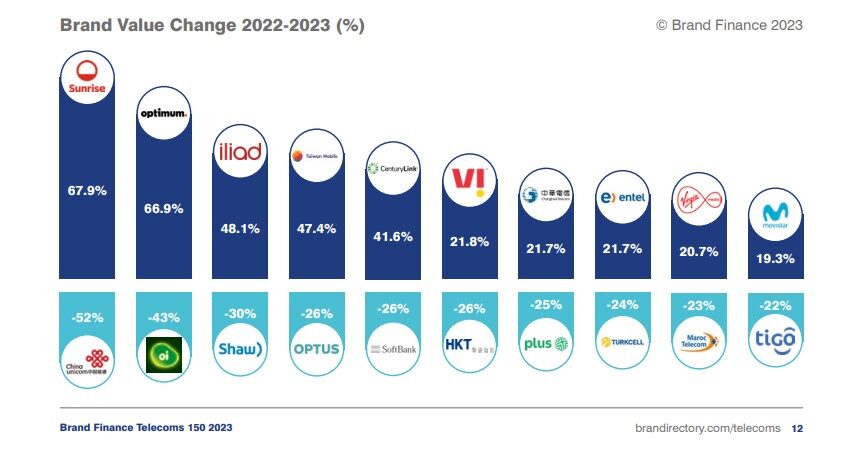

Sunrise is the fastest-growing telecoms brand following UPC merger, up 68%

Swiss full-service provider, Sunrise, is the fastest growing telecoms brand in the ranking after a 68% brand value increase took it to US$1.8 billion. This comes off the back of a successful merger with Switzerland’s largest cable operator, UPC, in 2021. As part of a brand refresh, Sunrise has also introduced a new brand design and logo. It has also launched the Sunrise Business brand, strengthening its identification with and positioning within the business customer segment.

U.S based brand Optimum followed closely behind as the second fastest growing brand with a 67% increase to a brand value of US$2.5 billion after a similarly successful merger. The brand merged with Suddenlink in 2022 and has combined all of the company’s telecommunications goods under a single name. In combination with this, it also launched a new nationwide brand campaign, “Get Closer, Go Farther”. This emphasises its promise to bring customers closer together with Optimum products and services.

Lorenzo Coruzzi, Senior Consultant, Brand Finance, commented:

“Both outlined mergers and subsequent brand-refreshes highlight two examples of the benefit for brands of adjusting their brand architecture and combining two or more weaker brands under a more distinct and consolidated master-brand. This indicates significant brand value potential to be unlocked by other such brands operating under an unconsolidated brand architecture.”

AT&T sees brand value growth after spinning off its media arm

AT&T (brand value up 6% to US$49.6 billion) saw brand value growth in 2023 following a redirection in business strategy in which it spun off its media arm in order to focus directly on its telecoms business. AT&T announced that it would spin off WarnerMedia into a new company in 2021. It completed the move in April 2022, to form a separate media company – Warner Bros. Discovery, Inc. AT&T has subsequently shown positive brand value growth of 6%. In 2022, the telecoms brand has focused on its go-to-market strategy, providing high-quality wireless and fibre services, while continuing to invest heavily in its 5G technologies.

Swisscom is the strongest telecoms brand, earning 92/100 and elite AAA+ rating, with Jio and Etisalat by e& as the second and third strongest brands

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 150,000 respondents in 38 countries and across 31 sectors.

Swisscom (brand value up 5% to US$6.3 billion) is the strongest telecoms brand with a Brand Strength Index score of 92, making it the third strongest brand globally and earning it an elite AAA+ brand rating. Its recent announcement of its new Fixed Wireless Access 5G service for business customers is a continuation of its pioneering work in the European 5G market. Trust, coverage and network perceptions and its customer service are what sets Swisscom apart against competition and other telco brands and is clearly reflected in Swisscom’s extremely high brand strength index score.

Indian brand Jio (brand value up 6% to US$5.4 billion) is the second-strongest telecoms brand with a brand strength index score of 90/100, earning it an elite AAA+ rating. This was a two-point rise from last year. The brand has particularly focused on its roll-out of 5G in India, now extending coverage to 257 cities in the country and looking to further increase this at a rapid rate. 5G services have already created widespread benefits to Indian consumers, as well in sectors such as education, healthcare and agriculture. These benefits and the growth opportunities that Jio’s 5G network has presented have helped Jio build an extremely strong brand strength index score, one of only two AAA+ rated telecoms brands in the ranking.

Etisalat by e& (brand value up 4% to US$10.5 billion) is the third strongest telecoms brand globally with a Brand Strength Index (BSI) score of 89.1 out of 100. Etisalat by e& is a telecoms brand of the global technology group e&. Evolved through a brand identity change last year, Etisalat by e& reflects a tech-driven telecoms brand enabled by superior 5G connectivity; elevated NPS scores due to richer personalised customer interactions; and increased employee satisfaction on account of vigorous company culture making it an attractive employer.

stc and Etisalat by e& lead in Middle East

Saudi Arabian brand stc (brand value up 17% to US$12.3 billion) is the most valuable Middle Eastern telecoms brand. It is also the second strongest telecoms brand in the Middle East with a brand strength index score of 87 out of 100 and a corresponding AAA rating. The brand’s value was positively affected by stc’s technological investments to keep delivering on its ambitious strategy and increased focus on the expansion of the brand in adjacent sectors such as ICT and IT.

Etisalat by e& (brand value up 4% to US$10.5 billion) is the second most valuable telecoms brand in the Middle East.

Safaricom has the highest Sustainability Perception Score, while Verizon has the largest Sustainability Perceptions Value

As part of Brand Finance’s analysis, research is conducted into the role of specific brand attributes in driving overall brand value. One such attribute, growing rapidly in its significance, is sustainability. Brand Finance assesses how sustainable specific brands are perceived to be, represented by a ‘Sustainability Perceptions Score’. The value that is linked to sustainability perceptions, the ‘Sustainability Perceptions Value’, is then calculated for each brand.

Kenyan telecoms brand, Safaricom (brand value up 3% to US$709 million) is perceived to be the world’s most sustainable telecoms brand, with an impressive Sustainability Perception Score of 6.46 out of 10.

As well as being the world’s most valuable telecoms brand, Verizon also has the highest Sustainability Perceptions Value, estimated at US$5.8 billion. While its position at the top of the table is not an assessment of its overall sustainability performance, it indicates how much brand value Verizon has tied up in sustainability perception. Brand Finance’s research finds that consumers around the world perceive that Verizon is minimising its negative impacts, reflected in Verizon’s top ranking in this area.

Huawei is the most valuable and strongest telecoms infrastructure brand

In addition to ranking the 150 most valuable and strongest telecoms operator brands, Brand Finance also ranks the top 10 most valuable and strongest telecoms infrastructure brands in the world in the Brand Finance Telecoms Infrastructure 10 2023 ranking.

Huawei (brand value down 38% to US$44.3 billion) continues its dominance at the top of the ranking. Huawei has lost significant brand value in connection to US sanctions, due to political and regulatory confrontations, that have caused a contraction in the geographies where it can operate. It has also suffered in relation to a global semiconductor shortage and a slump in demand for smartphones. Although it is losing brand value, the brand is still the strongest telecoms infrastructure brand with a Brand Strength Index Score of 79.9 out of 100 with a corresponding AAA- rating.

View the full Brand Finance Telecoms 150 2023 report here